Pharma BD Hiring Is a Senior Game: 80% Management, $187K Median

Analysis of 410+ business development, licensing, and alliance management job postings in pharma and biotech. BD roles skew heavily senior with a 47% management premium.

BD in pharma is where the deals happen, they handle licensing, M&A, strategic partnerships, alliance management and more. I pulled 410 BD-related job postings from the past 6 months to see what companies are hiring, what they’re paying, and what the roles actually look like.

Who’s Hiring #

80% of BD postings are management-level, with a median salary of $187K and a 47% premium over individual contributor roles. This is the most top-heavy function I’ve analyzed on PharmaPayWatch.

AbbVie dominates BD hiring with 110 postings, more than the next two companies (Abbott at 57 and Medtronic at 33) combined. Johnson & Johnson (29) and Bristol Myers Squibb (24) round out the top five.

But “BD” means different things at different companies. Nearly three-quarters of AbbVie’s 110 BD postings are Allergan Aesthetics field sales roles - territory managers selling BOTOX Cosmetic, JUVEDERM, and SkinMedica to aesthetic practices. Only a handful are strategic pipeline BD (e.g., “Director, Oncology Business Development”).

Abbott’s mix is similarly broad: diagnostics informatics sales reps, Lingo biosensing partnership managers, and structural heart strategic partnerships. Medtronic is the closest to traditional BD of the top three, with corporate development associates evaluating M&A targets and surgical alliance account managers.

One of the things I’ve noticed looking at these postings is that “business development” is one of the most overloaded titles in pharma. Depending on the company, it can mean anything from field sales to negotiating licensing deals.

Diagnostics Companies Are Building BD Teams to Sell Back to Pharma

Precision diagnostics companies are actively hiring BD leaders to partner with pharma. Caris Life Sciences, Exact Sciences, Natera, and Tempus AI combined for 18 BD postings in this window.

Caris Life Sciences I’ve been tracking Caris’s hiring through their IPO last June, and the post-IPO commercial buildout continues. Their BD postings are primarily at the senior level: Senior Director-level “Biopharma Business Development Lead” in August, a Senior Alliance Manager in January, and a VP-level “Global BioPharma Business Development Lead” posted just last week. Caris’s overall hiring volume hit 158 postings in January, which is the highest since we started tracking them, and biopharma partnerships is clearly a priority.

Exact Sciences posted 7 BD roles including “Principal Biopharma Business Development Partner” and alliance managers, building out the commercial partnerships side of their oncology diagnostics business. Natera is hiring a “Director, Business Development - Early Cancer Detection” to commercialize their MRD platform, plus alliance managers for institutional research partnerships. Tempus AI posted directors for MRD strategy and multi-omics DTC partnerships.

The Seniority Gap #

The most striking pattern for BD roles over the past few months has been the seniority distribution. Unlike data science or bioinformatics roles where you see a healthy mix of junior and senior positions, BD hiring is overwhelmingly senior:

- Senior/Management: 80% of all postings

- Mid-level: 9%

- Entry/Associate: 5%

The management premium is 47%: management roles pay a median of $191K compared to $130K for individual contributors.

What They’re Paying #

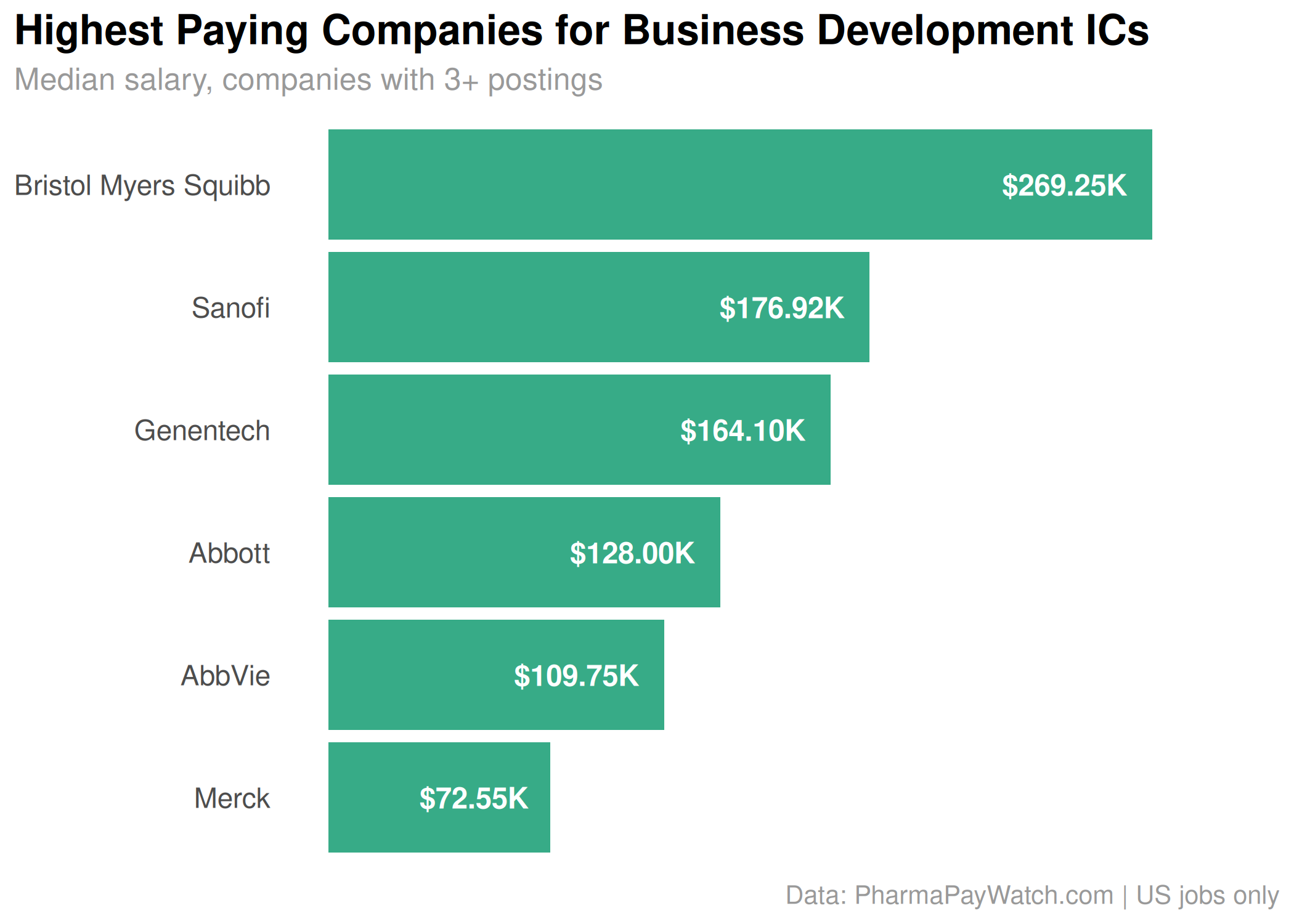

Bristol Myers Squibb leads compensation for BD individual contributors at $269K median. Sanofi ($177K) and Genentech ($164K) also pay well. The overall median across all BD roles is $187K, with the full range spanning $70K at entry level to $361K at the senior end.

For the full compensation breakdown by experience level, see the 💰 Business Development Salary Guide .

Five Flavors of BD #

Not all BD roles are the same. Here are the categories of BD-like roles I considered:

| Category | Postings | % Management | Avg Salary |

|---|---|---|---|

| Business Development | 241 | 81% | $174K |

| Alliance Management | 99 | 77% | $181K |

| Strategic Partnerships | 44 | 100% | $204K |

| Corporate Development | 16 | 88% | $199K |

| Licensing | 9 | 44% | $137K |

Strategic Partnerships roles are the highest-paid sub-type at $204K and are 100% management-level. These tend to be senior roles managing complex multi-party relationships.

Corporate Development (M&A-focused) pays $199K on average and also skews heavily senior. These are the people evaluating acquisition targets and running due diligence.

Licensing is a smaller category with a lower average salary ($137K) and the most balanced IC/management split at 44%. Some of these roles are more operational (contract management) rather than strategic deal-sourcing.

If You’re Looking for BD Roles #

It’s a second-career function. The 80% management rate means companies want experience. Most paths into BD seem to come through medical affairs, commercial, or consulting - not directly from graduate school.

Strategic Partnerships is the highest-paying sub-type. Partnership management roles pay the most and are the most consistently senior.

Read past the title. AbbVie leads in BD posting volume, but most of those are aesthetics sales territories. Carefully read the description to better filter for the type of role you’re looking for.

The dealmaking market is active. 410 BD postings in 6 months, with consistent weekly hiring volume, suggests pharma’s appetite for external innovation remains strong heading into 2026.

The Deals These Teams Are Working On #

If you’re in one of these BD or strategy roles, or you’re an analyst covering the companies that hire them, you might find RxDataLab useful. It’s a separate project where we track pharma and biotech company activity from SEC filings, clinical trials, and institutional ownership data.

A few things relevant to what this post covers:

Strategic Signals Weekly tracks licensing deals, strategic alternatives announcements, and financing events directly from SEC filings. Companies don’t always put out a press release when they explore a strategic review or close a quiet financing, but they do have to file with the SEC. We monitor all of it systematically so you don’t have to. The live dashboard updates daily.

BioHedge Monitor tracks Schedule 13D/13G filings from biotech-focused hedge funds. When an institutional investor crosses the 5% threshold or files an activist 13D, it shows up here with ownership percentages, position changes, and filing gaps. Importantly, we show these changes with context meaning recent trial changes/updates, market movements, and relevant regulatory filings are shown right alongside them.

All data comes from primary sources (SEC EDGAR, ClinicalTrials.gov) with links to original filings. Traceable data, not commentary.

We also offer more detailed context, reach out to [email protected] or contact us for more details if you want deal activity filtered by therapeutic area or specific companies.

Pharma Industry Intelligence Newsletter

Get weekly data-driven analysis of job postings, hiring patterns, and compensation trends across the pharmaceutical industry.

- Data from 58 pharma & biotech companies

- Compensation and job role analysis

- Weekly market movement reports

View sample newsletters before subscribing