Tracking Hiring Patterns Through a Biotech IPO

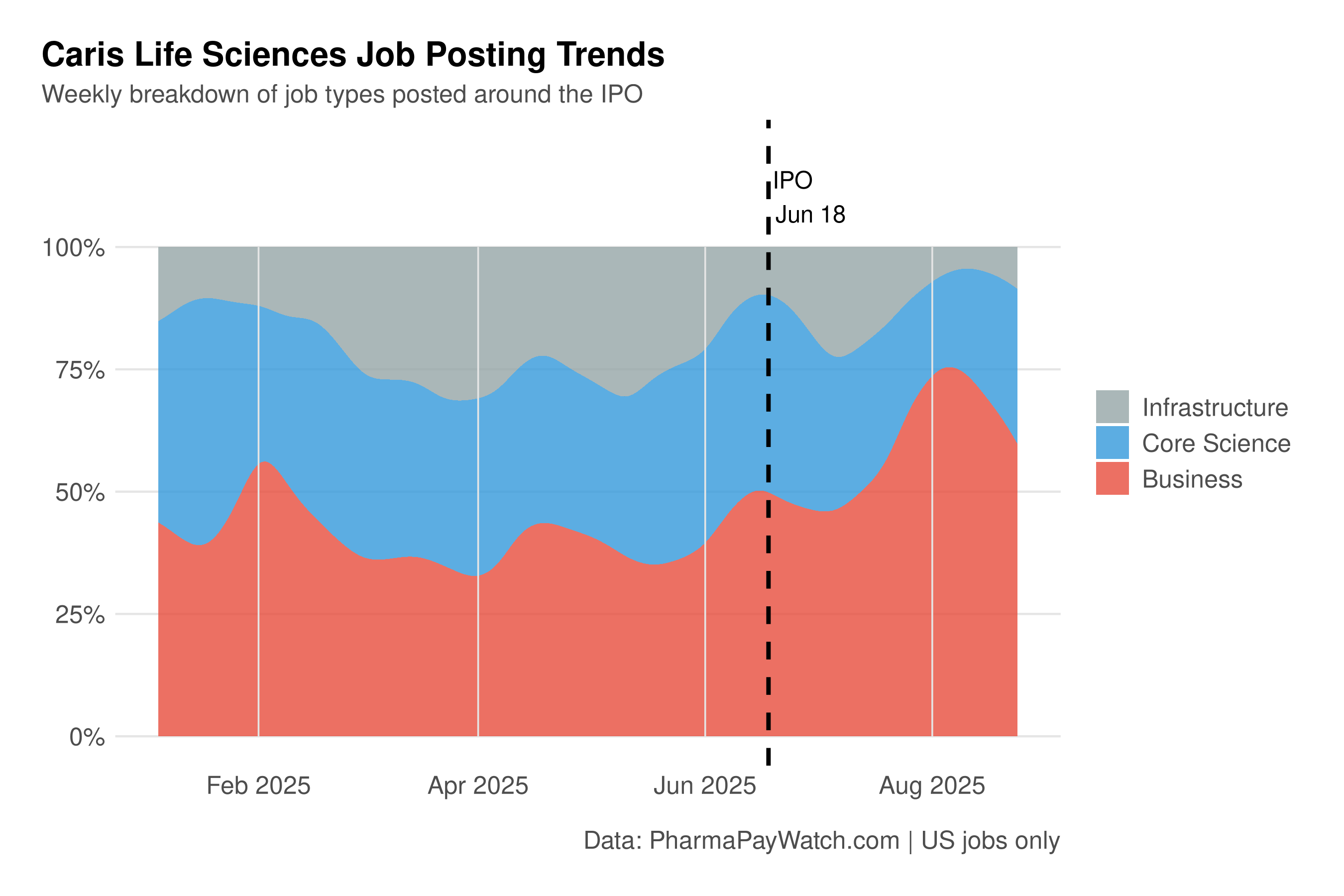

Case study of Caris Life Sciences shows how biotech hiring shifts from science and infrastructure to commercial roles after going public, with early IPO signals appearing in job postings months before.

When biotech companies go public, do they change their hiring practices? I’ve been tracking Caris Life Sciences since December 2024, and they went public in June of this year. This is the first company I’ve monitored through an IPO, making it an initial case study of hiring pattern changes around public offerings.

Caris Life Sciences #

Caris is a molecular diagnostics company focused on precision oncology. They provide tumor profiling services that combine genomic sequencing with artificial intelligence and operate one of the largest clinico-genomic databases in oncology.

Hiring Patterns #

PharmaPayWatch categorizes jobs into 9 career paths. For this analysis, I simplified those into three broad categories:

- Business and Administration: Commercial roles including sales, medical affairs, finance, and administrative functions

- Infrastructure: IT, software, data science, manufacturing, and facilities— the virtual and physical foundations that support operations

- Core Science: Wet lab research, clinical operations, and quality & regulatory work

While this grouping combines disparate functions like IT and manufacturing, it provides a clear view of strategic priorities. I can break down specific role changes in more detail if there’s interest.

The data shows Caris focused heavily on core science and infrastructure in the months leading up to their IPO. Following the public offering, total hiring volume remained steady, but the composition shifted dramatically toward business and administration roles. By early August, 75% of posted roles were business/administration focused—the highest proportion since I started monitoring.

Early IPO Signs #

This shift to commercial roles occurred after going public, but there were earlier signs of IPO preparation. In February, I noted SEC Analyst positions appearing. These were followed by VP-level investor relations roles and stock compensation roles in the months leading up to the offering.

These specialized finance and regulatory roles indicate preparation for public company requirements months before the actual IPO date.

What This Reveals #

While this represents just one case study, it demonstrates how job posting data can reveal strategic business movements that aren’t obvious from press releases or earnings calls. Companies preparing for public offerings appear to:

- Build regulatory and finance infrastructure months in advance

- Shift hiring priorities toward revenue-generating roles post-IPO

As I continue monitoring more companies through major transitions, we’ll build a clearer picture of these patterns across the industry. Hiring data offers a forward-looking view into company strategy — something we’ll keep uncovering as PharmaPayWatch grows.

Are you interested in specific role breakdowns or tracking other companies through major transitions? Want to see a detailed role breakdown? Email me at [email protected], I read them all!

Pharma Industry Intelligence Newsletter

Get weekly data-driven analysis of job postings, hiring patterns, and compensation trends across the pharmaceutical industry.

- Data from 58 pharma & biotech companies

- Compensation and job role analysis

- Weekly market movement reports

View sample newsletters before subscribing