Neuroscience Pioneer to Asset Sale: Sage's Final Months

An analysis of Sage Therapeutics’ final months before its $8.50/share acquisition by Supernus Pharmaceuticals, using hiring data to trace the company’s shift from commercialization efforts in women’s health to an asset-only sale.

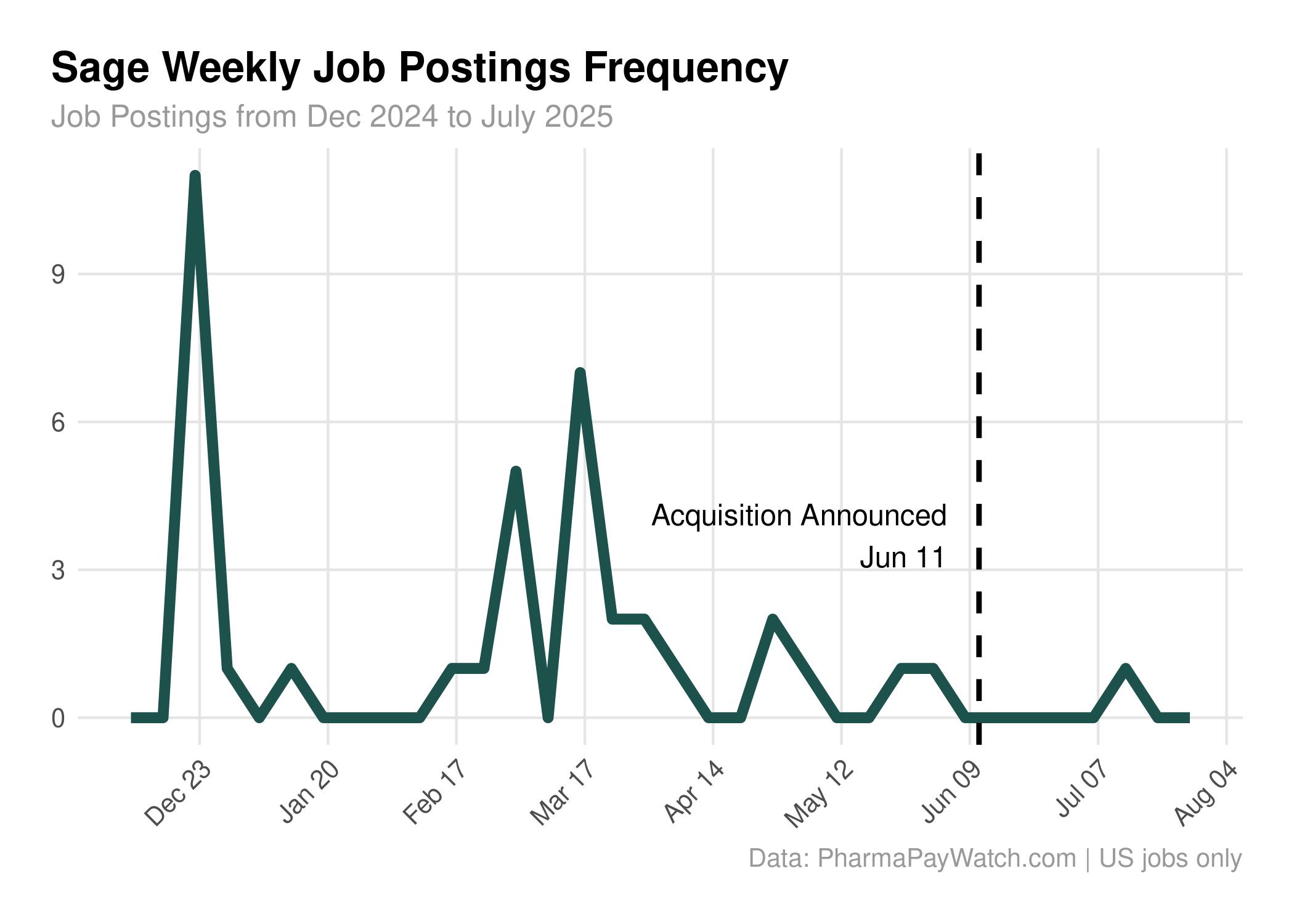

On June 11, 2025, Supernus Pharmaceuticals announced plans to acquire Sage Therapeutics for $8.50 per share. Two weeks later, on June 26, Sage filed a WARN with Massachusetts indicating they were laying off all 338 employees in August pending deal closure.

The story of Sage has been well covered, but here I wanted to look at how the company operated in early 2025 leading up to the acquisition.

The Neuroscience Powerhouse #

Sage Therapeutics developed the breakthrough-designated postpartum depression treatments Zulresso and later Zurzuvae. The latter was the first oral treatment specifically approved for postpartum depression. These treatments were breakthroughs in women’s health, targeting a condition that affects up to 20% of new mothers. The company had built its identity around neuroscience innovation, particularly in areas where few effective treatments existed.

But commercial success proved elusive, and when Zurzuvae was rejected for the larger indication of Major Depressive Disorder, Sage was in a tough spot and running out of runway.

What the Hiring Data Shows #

I started tracking Sage’s job postings in January 2025 (with existing positions dating from December 2024). Over the following seven months, they posted just 38 positions, a modest number for a company of their size.

Early 2025: The Last Commercial Push

At the end of 2024 and beginning of 2025, Sage was still betting on commercial growth. They posted 12 regional positions for Sr. Neuropsych Account Manager roles in Women’s Health. These were sales positions designed to drive adoption and awareness of their postpartum depression treatment, an intent that was reflected in quarterly SEC filings in 2024.

March: Building Infrastructure

After the initial sales hiring, things went quiet until March. Then Sage posted a mix of operational roles, including medical affairs, patient affairs, and regulatory positions. These roles also indicate that Sage was still focused outwardly on commercialization and growth. However, we now know they were also fielding offers. Their Zurzuvae development partner Biogen offered to buy Sage for $7.22/share on January 10, 2025.

Summer: Radio Silence

Leading up to the June acquisition announcement, hiring nearly stopped. Sage posted two Associate Director, Commercial Learning roles in June, with the final one a few weeks before the WARN notice.

The last position Sage posted was a Senior Neuropsych Account Manager for Columbia, SC, on July 17, presumably a mistake since the WARN was released a month earlier.

Asset Acquisition #

In the end, Supernus wanted Sage’s IP, and outbid Biogen with $8.50/share and took only the assets, leaving over 300 Sage employees in the cold.

Sage pursued challenging neuro diseases like Huntington’s, Essential Tremor, and Postpartum Depression. Whether Supernus will continue that R&D focus or simply extract value from existing assets remains to be seen.

Pharma Industry Intelligence Newsletter

Get weekly data-driven analysis of job postings, hiring patterns, and compensation trends across the pharmaceutical industry.

- Data from 58 pharma & biotech companies

- Compensation and job role analysis

- Weekly market movement reports

View sample newsletters before subscribing