HEOR Hiring Is Top Down and Payer Centric

Analysis of 1,300+ HEOR job postings reveals pharma companies prioritize payer relations over traditional health economics, with 91% of roles at management level

Health Economics and Outcomes Research (HEOR) teams handle the business side of drug development - market sizing, pricing strategy, and payer negotiations. They’re involved early in the pipeline to assess commercial viability and later to secure reimbursement.

Payer-focused Positions Dominate HEOR Hiring #

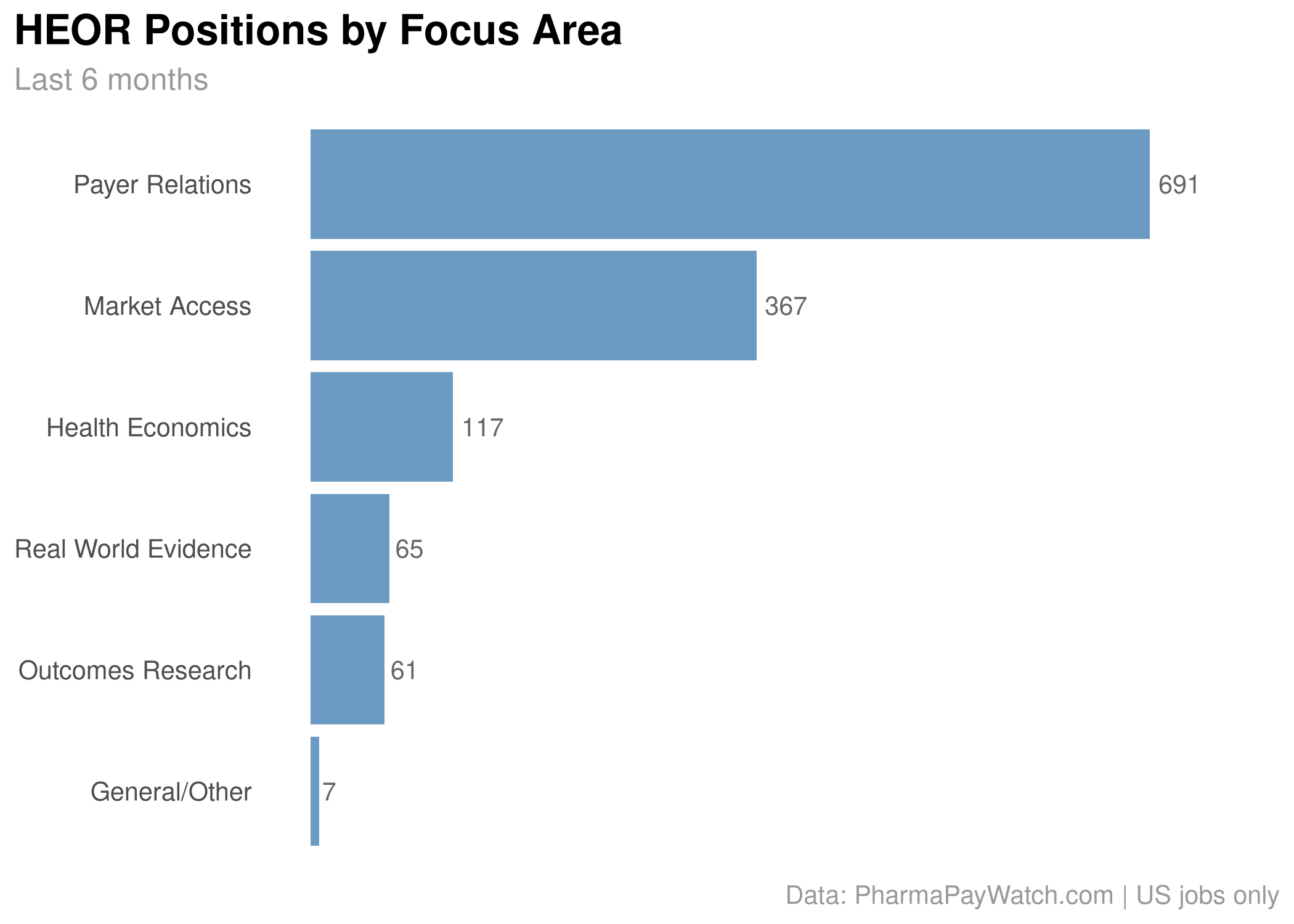

Over the past 6 months, I pulled 1,300+ pharma job postings containing HEOR-related terms like “market access,” “payer,” “health economics,” “outcomes,” and “reimbursement.” The results show far more mentions of direct payer engagement than traditional health economics work.

“Payer Relations” roles (695) far outnumber traditional “Health Economics” positions (119), suggesting companies want people who can directly engage with insurance plans and Medicare rather than just run cost-effectiveness models.

Big Pharma Leads the HEOR Hiring #

The largest companies are driving most of the activity:

Novartis (245), AbbVie (223), and Sanofi (151) top the list. This makes sense since these companies have the most products facing pricing pressure and they have the resources to build substantial HEOR teams.

Building From the Top Down #

What’s notable is the seniority level: 91% of posted roles were management or director-level positions. Companies are hiring leaders first, presumably to establish strategy and then build teams underneath.

This could reflect the specialized nature of HEOR work, since you need experienced professionals who can interface with senior payer executives and internal leadership. It also suggests companies view this as a strategic investment rather than just adding analytical capacity.

The timing aligns with business cycles too. Many payers finalize their formularies for the following year in Q4, making fall a critical period for market access activities.

Bonus: Patient Advocacy #

A reader asked about Patient Advocacy patterns after last week’s 💰 MSL post. Searching the PharmaPayWatch database revealed 204 positions over the past 6 months, with AbbVie (49), Sanofi (29), and Takeda (24) leading the hiring.

The roles span a wide range of functions. Some focus on community engagement and reputation management, like this Patient Engagement & Advocacy Manager at Neurocrine Biosciences, which involves “comprehensive patient advocacy landscape assessments” and coordinating “locally sponsored events while strengthening corporate reputation.”

Others are more analytically focused, like Takeda’s Market Access Forecasting role in Payer and Patient Services that combines patient services with payer analytics: “leverage data across multiple sources to create analyses” and “support Market Access field teams” with “gross to net forecasting and post deal analytics.”

This range suggests “Patient Advocacy” has become an umbrella term covering everything from traditional community relations to data-driven market access support.

Data from PharmaPayWatch.com | US jobs only | Questions? Reply to this email or reach out to [email protected]

Pharma Industry Intelligence Newsletter

Get weekly data-driven analysis of job postings, hiring patterns, and compensation trends across the pharmaceutical industry.

- Data from 58 pharma & biotech companies

- Compensation and job role analysis

- Weekly market movement reports

View sample newsletters before subscribing